Foundational Planning

Web App for New Financial Planners

Foundational Planning is a product that provides goals-based planning in an easy-to-use, modular way.

The product caters to those who have less complex planning needs or are new to financial planning. I was brought on just after the product’s beta release. The product stakeholders wanted to obtain feedback on the initial release, and obtain direction on what features financial advisors would want to see next.

Problem Statement

As an advisor who is new to financial planning, I need to quickly create financial plans for my clients to build my book of business, but financial planning software is often complex and takes time to learn. This makes me feel discouraged because I now have a high barrier to becoming a successful financial advisor.

My Roles

Product Design

UX Design

UX Research

Design Process

Discovery/Research

Information Architecture

Wireframes

Prototyping

Follow-up

Using a combination of internal advisor group testing, moderated individual testing, and unmoderated surveys geared toward financial advisors new to planning, my team and I found numerous ways to improve the product and provide additional functionality. Among the many improvements were adding more information on the outputs of the modules, improving the user flow from module to module, and adding important features such as life insurance gap analysis.

In order to add more information, I worked with our internal advisor team to brainstorm a number of new outputs to the modules, which included new charts, and new summaries of information. I also worked with other designers to create more conversational forms as part of the basic modules, so that an advisor could fill out the modules interactively with their clients. To introduce the new life insurance gap analysis, I used examples of how eMoney illustrated it in their older reports and tools, and asked advisors to sketch out how they would visually represent a gap in their client’s life insurance needs.

To better streamline the data entry process for advisors, I worked with advisors to create a journey map and used it to identify the most common paths through the process. Using that information, I was able to understand what the most common paths through the modules were, leading our team to be able to add links to subsequent modules from the output of a previous one.

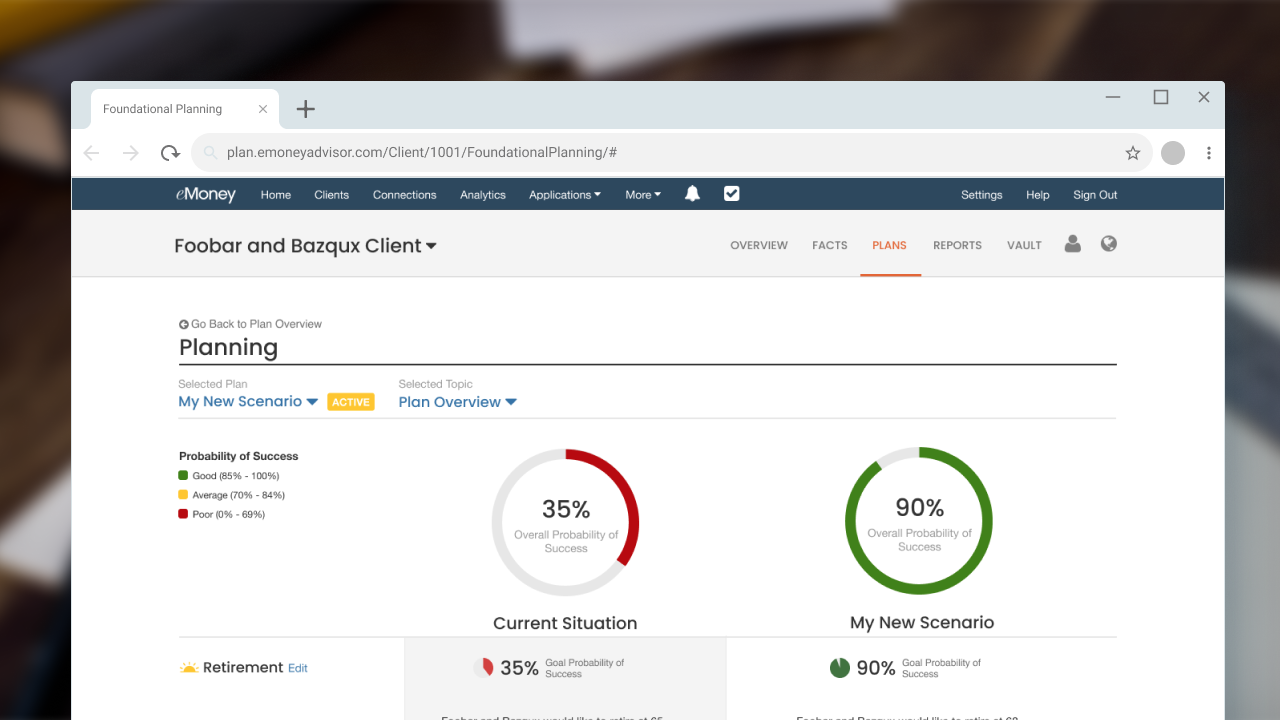

Using the feedback generated by our research participants, I was able to streamline the process of creating a financial plan in the product by summarizing the differences between the end-investor’s current situation and the proposed changes to their financial outlook. Additional functionality was added by the design of Foundational Planning’s first module, Life Insurance Gap Analysis. Using this tool, a financial advisor can help the client understand the ramifications of a premature death for a married/partnered client, and suggest additional life insurance policies to replace lost income in case of unforeseen circumstances.

In addition to Life Insurance Gap Analysis, another module regarding Asset Allocation was designed and implemented. This tool allowed financial advisors to understand their client’s tolerance for investment risk and suggest a strategy to re-allocate assets to match. This reallocation was one of many improvements made to the Proposed Plan module, which summarizes the outputs of each module and enables the advisor to suggest improvements to a client’s financial plan to improve potential returns.

In order to validate the changes we had made to the product, I worked with our product management team to track user flows throughout the process, including validating the path between modules and through the new modules. Additionally, we received a lot of positive feedback in follow-up unmoderated testing and NPS scorecards. A big selling point for advisors was the Life Insurance Gap Analysis module; many advisors come from an insurance sales background, and providing a simple way to illustrate the value of life insurance was crucial.

As of today, the product is now being used by many of eMoney’s partner enterprise firms and thousands of independent financial advisors. This was the most thorough regimen of user research I had been involved in so far, and I learned much about how to moderate a user study, select participants, conduct group interviews, and track user actions across a product for use in quantitative studies.